Export Credit Guarantee Corporation Of India (ECGC)

Probationary Officer PO Recruitment 2023

|

| WWW.RESULTBHARAT.COM |

Application Fee

- General/ OBC/ EWS Candidates : Rs. 850/-

- SC/ ST/ PH Candidates : Rs. 175/-

- Payment Mode: Pay the Exam Fee Through Debit Card / Credit Card / Net Banking / Mobile Wallet / Cash Card Fee Mode.

|

Important Dates

- Online Apply Start On: 02 May 2023

- Last Date For Apply Online : 11 June 2023

- Last Date For Fee Payment : 11 June 2023

- Admit Card: 07 July 2023

- Online Exam Date : 15 July 2023

- Result Declared : August 2023

- Interview Date : August/ September 2023

- Final Result Declared : 08 December 2023

|

Age Limit as on 01-04-2023

- Minimum Age : 21 Years.

- Maximum Age : 30 Years.

- Age Relaxation Extra as Per Rules.

|

Vacancy Details

Total Vacancy : 17 Post

|

Post Name

|

UR |

SC |

ST |

OBC |

EWS |

Total Post |

| Probationary Officer PO |

06 |

05 |

02 |

02 |

02 |

17 |

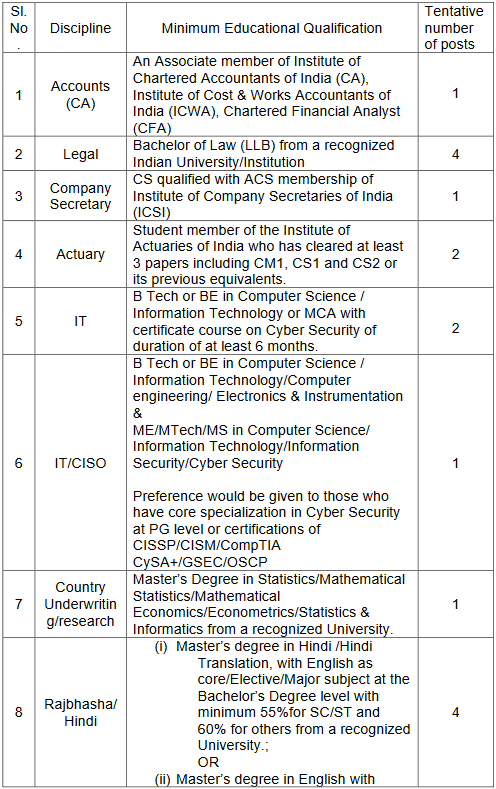

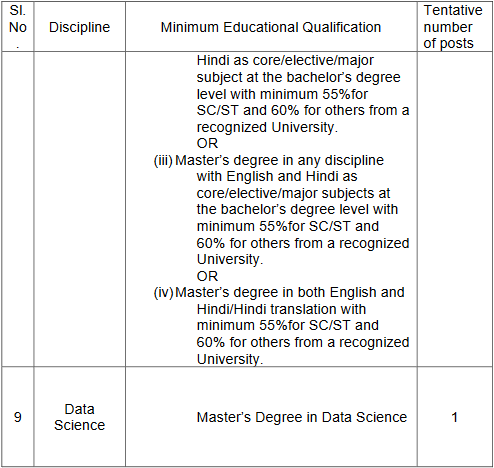

Post Wise Education Qualification as on 01-04-2023

|

|

|

Pay Scale & Mode of Selection

-

Pay Scale: : Rs.53600-2645(14)-90630-2865(4)-1,02,090

-

Mode of Selection: Selection on the Basis of Online Exam & Interview

|

|

|

All Registered Candidates Can Download Final Result Now.

|

| Disclaimer : The Examination Results / Marks published in this Website is only for the immediate Information to the Examinees an does not to be a constitute to be a Legal Document. While all efforts have been made to make the Information available on this Website as Authentic as possible. We are not responsible for any Inadvertent Error that may have crept in the Examination Results / Marks being published in this Website nad for any loss to anybody or anything caused by any Shortcoming, Defect or Inaccuracy of the Information on this Website. |

|

IMPORTANT LINKS

|

Download Final Result

|

|

Download Result

|

|

Download Interview Schedule

|

|

Download Admit Card

|

|

Apply Online

|

|

Download Notification

|

|

Official Website

|

|

Join Our Telegram Group

|

|

Top Online Form 2023 (All Current Job List)

|

|